Buying the Copper Mountain was only the Beginning: China and South America

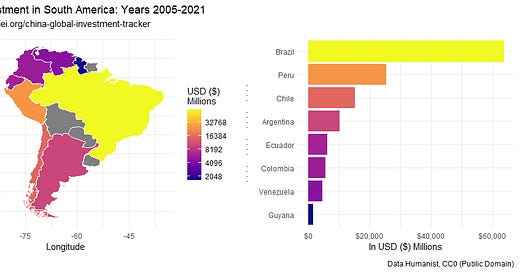

This post and companion Data Dashboard (with more graphs and charts, including breakdowns per nation) provide an update on China’s extensive investment in and resource extraction from South America.

In late 2007, China bought the copper mountain — the mining rights to Mount Toromocho in Peru — for an estimated $3 billion cash investment (BBC News, 17 June 2008; Moyo, 2012). At the time of the deal, some commodity experts claimed China had overpaid (as reported in Moyo, 2012). But as hindsight can reveal foresight, the steady global rise in copper prices despite increased production and recycling — a rise in part because of China’s own immense domestic demand — has made buying the copper mountain a wise investment.

China’s multi-billion-dollar investments in South America did not stop in 2007. Nor were such limited to Peru, or even to mining and metals. The 21st century has witnessed a relentless change in Sino-South American relationships, economic and political. For many nations in South America (as elsewhere), China is either the number one or number two trade partner. (Map below courtesy of the Belt and Road Research Platform, a joint collaboration between the Leiden Asia Centre, the Clingendael Institute, and the Leiden University Institute for Area Studies).

The Usual Suspects Pay Brief Attention

Time Magazine (4 February 2021), considering both South America and the Caribbean, declared that “The U.S. and China Are Battling for Influence in Latin America, and the Pandemic Has Raised the Stakes.” The Council on Foreign Relations (CFR) likewise weighed in on “China’s Growing Influence in Latin America” (12 April 2022):

“Over the past two decades, China has developed close economic and security ties with many Latin American countries, including Brazil and Venezuela. But Beijing’s growing sway in the region has raised concerns in Washington and beyond.”

In terms of economic hegemony, Bloomberg News (18 February 2022) has already conceded South America to China: “How China Beat Out the U.S. to Dominate South America.” Based on the results in our companion Data Dashboard for this post, which uses the data from the China Global Investment Tracker, American Exile cannot dispute the claim that China now economically dominates South America.

Academia Paying Sustained Attention

Beyond the usual suspects, more thorough and hence damning data and analysis comes from academia, not from the occasional MSM or Industry Advocacy fear porn. Two highly recommended sources:

The Global Development Policy Center at Boston University (GDPC) annually publishes the “China-Latin America and the Caribbean Economic Bulletin.”

The Belt and Road Research Platform (a joint collaboration between the Leiden Asia Centre, the Clingendael Institute, and the Leiden University Institute for Area Studies). Please see their “The Americas” publication database

At American Exile, we have no obligation to agree with the established experts — but we do concur with the overall emerging consensus on Sino-South American relationships. To summarize:

Unquestionably, China’s activities will continue to shape the national economies of South America, to impact shared global markets, and to reconfigure political relationships between the global North and South.

Yet the American public has little interest in or awareness of how China is transforming South America. Perhaps we should pay less attention to Eastern Europe and more to the Americas. So back to South America.

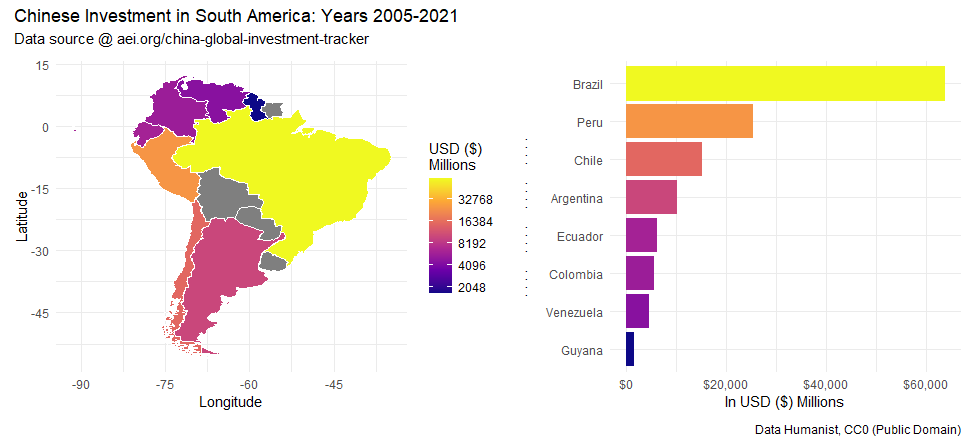

Energy and Metals — especially Green Metals

In South America, China invests the most heavily in two sectors: Energy and Metals. The Energy sector is not simply fossil fuels — not simply extracting oil for export to China, although that certainly has a major role. China has also built hydroelectric dams, has been in discussion about building nuclear power plants, and in Argentina has built the largest Solar Park in Latin America. Like it or not, much of the global South views the Chinese-Argentinian venture Cauchari Solar Park as a showcase of China’s practical leadership on clean energy technology.

The China-Argentina partnership also concerns lithium, which bridges the Metals sector (as a raw resource) and the Energy sector (as part of a finished technology offering). In South America, China is actively mining lithium in Argentina and Chile and exploring elsewhere on the continent. Bloomberg News has recently reported on “The Trouble with Lithium” (25 May 2022: forecasted demand greatly exceeding forecasted supply) and “How Lithium Shortages Could Obliterate the EV [Electric Vehicle] Transition” (10 May 2022). But troubles and shortages for whom? Not China.

We break this down a bit more below, but China’s obsession with and committed resource extraction of the “green metals” requires some additional context.

So what are “green metals”? To cite NASDAQ (31 May 2022) :

“Green metals, which include familiar fare such as copper, lithium, tin, and zinc, among others, are integral in the production of clean energy concepts including batteries, solar panels, and more. In other words, green metals have long-term tailwinds.”

In South America as elsewhere globally, China is all-in on mining green metals and rare-earth elements. These resources are essential for manufacturing high-tech as well as engaging in any “Green New Deal” transformations, and China is stockpiling these resources. Even as China burns coal and oil for domestic energy and remains the world’s leading emitter of carbon dioxide and other greenhouse gases (ABC News, 29 October 2021), China positions itself as an — if not “the” — essential supplier of clean energy technology.

Cauchari Solar Park, Argentina; and Shenzhen, China

That said, China does have its own “Green New Deal” ambitions, and Cauchari Solar Park in Argentina is not China’s only proof of concept. To its considerable credit, China has transformed Shenzhen, a city of over 12 million people in Guangdong Province, into a showcase of carbon-neutral public transportation. All public buses went electric before 2018. Likewise, now over 99% of the taxis are EVs. But as TechCrunch astutely noted in 2019:

“Underneath the ostensible goal of improving air quality is China’s ambition to be a world leader in battery technologies, which could subsequently drive employment and export sales.”

Indeed. When China sees green, China sees profit and power.

Let the American and European elites moralize and masquerade as planet-savers as they hip-hop trip-hop on private jets across the globe to various conferences on Climate Change and Carbon Neutrality. China prepares for the future by globally extracting and domestically stockpiling essential resources. By turning theory into practice into implementation. By winning allies among nations which the Global North knows only from Google Maps or the occasional CNN International television screen report at the airport. Among the environmental apocalypse drama queens who dominate the MSM headlines (John Kerry of the USA, Special Presidential Envoy for Climate, first and foremost among them), the representatives from China lurk in the background as the say little, promise nothing doomsday preppers.

And China is preparing. China, as the Center for Strategic and International Studies (CSIS) correctly observes, is the

“dominant global supplier of rare earths, a collection of 17 minerals that are indispensable to the manufacturing of smartphones, electric vehicles, military weapon systems, and countless other advanced technologies.”

But China has been restricting its own exports of rare earth elements since 1990 (China Power, 2022). Moreover, as the mining industry expert Naimul Karim (7 June 2022) has warned:

“As demand for rare earths rises, world’s biggest producer [China] might stop exporting them [altogether].”

Rather than committing to selling rare earth elements from its own mining operations to USA or the EU, China prefers to extract rare earth elements by investment and mining in South America and Sub-Saharan Africa (White & Case, 15 September 2021). Forecasting a growing domestic — as well as international — demand, China is stockpiling for the future.

Rare Earth Elements: the USA Wakes Up?

Some good news, perhaps: a few American members of Congress are catching on. As Bryant Harris of Defense News (23 May 2022) reported: “Congress and Pentagon seek to shore up strategic mineral stockpile dominated by China.” The USA strategy, such as it was, involved selling off the stockpile. As reported by Defense News (23 May 2022):

“The stockpile was valued at nearly $42 billion in today’s dollars at its peak during the beginning of the Cold War in 1952. That value has plummeted to $888 million as of last year following decades of congressionally authorized sell-offs to private sector customers.”

Representative Seth Moulton, D-Mass., both stated the matter plainly but missed a key concern:

“China clearly has a comprehensive global strategy to corner the market on these materials and we’re behind and we’re playing catch-up.”

By investment and mining in South America and Sub-Saharan Africa, China is trying to take the market out of the equation. Not just corner it.

The market will never vanish. There will always be a supply of rare earth elements for those willing and able to pay. But China gives priority to its own plans — and China, unlike the USA, does not want to depend on the global marketplace for either green metals or rare earth elements. This to China is like running out and buying a fire extinguisher for your kitchen at the moment you realize your kitchen is on fire.

China’s Carbon Neutrality Goals: A Different Vision

It is not all about market-efficiency, keeping inventory to a minimal, running lean, and doing things in real time. The world is not as perfect as our theories about the world. Your author Data Humanist lived and worked in mainland China for five and half years. Yes, they have a different perspective. Yes, the cliché holds: many Chinese think long-term, in terms of generations and more.

As the international consulting firm White & Case reported (15 September 2021):

“China has set a national target to achieve carbon peaking by 2030 and carbon neutrality by 2060, prompting an active push by the country's mining sector to pursue industry transition and achieve a low-carbon production plan.”

China, contrary to what Representative Seth Moulton has suggested, is not on a buying spree. China has a global investment and mining campaign to secure the resources BEFORE they come to market as commodity products. Understanding this difference is crucial. By securing a near-monopoly on rare earth elements, China can largely ignore the market forces predicated upon free trade. By having strong positions in green metals, and its own growing domestic demand, China can meet its goals while the other highly developed nations scramble for resources or purchase their clean energy technology from China. Win, win — for China.

The graph immediately above courtesy of China Power @ CSIS reveals the USA dependence on China for rare earth elements. Hint to the USA: relying on market efficiencies in a rigged market is not the best strategy. Complaining that such is unfair and theorizing it away as “not supposed to be that way”: just sad denial.

On what drives China to globally invest and extract, to cite White & Case (15 September 2021) again:

“As with the trend globally, ‘green metals,’ including copper, nickel, lithium, cobalt and rare earth metals, will be in high demand in China's push to meet carbon-neutrality targets and the rapid development in sectors such as new energy vehicle, photovoltaics and wind power.

Other than rare earth, China's demand for imports of other critical metals in the next decade remains high and will be increasingly met by production in the countries that Chinese mining companies invest in, particularly those that are part of the ‘Belt and Road’ infrastructure development strategy.”

We typically do not think of South America as being part of China’s “Belt and Road" initiative. Silly North Americans. More absurdly, our political leaders and power elite pundits hold that China MUST sell from its stockpiles if the USA wants to buy. But why? Seriously. Why?

Because if they do not, the USA will accuse China of hoarding? Good luck with that. Again, China already has plans for its stockpiles: China has a buyer — China. And for the finished products, China has a global list of nations it intends to sell added value high-tech products — but not the resources needed to make such products.

Beyond Resource Extraction

But in South America, although Energy and Metals (mining) remain the leading sectors for investment, China is doing more than extracting resources. China is investing in multiple sectors and so transfiguring the national economies of (so far) eight nations: Argentina, Brazil, Chile, Columbia, Ecuador, Guyana, Peru, and Venezuela. The graph below shows the breakdown by sector in USD ($) Millions.

The above graph shows Chinese investment per sector, but much greater is China’s overall trade with South America. According to our would-be overlords at the World Economic Forum (17 June 2021), China’s trade with Latin America (South America and the Caribbean):

Grew 26-fold between 2000 and 2020.

Expected to more than double by 2035, to more than $700 billion.

The response by the USA in terms of developing and strengthening South American partnerships? Wait for it.

In November 2013, John Kerry, then President Barack Obama's Secretary of State and now President Joseph Biden’s Special Presidential Envoy for Climate, told the Organization of American States: “the era of the Monroe Doctrine is over” (The Diplomat, 21 November 2013).

The Monroe Doctrine is Over. Next?

Fair enough. The era of the Monroe Doctrine is over. When not ignored, Kerry’s policy statement was generally praised by analysts. Zachary Keck (21 November 2013) offered the standard rationale:

“Although America’s superior military power is what ultimately ensures its regional hegemonic status, this is an instrument that should only be used overtly as a last resort. …

The better, more efficient way to sustain regional hegemony is for the hegemonic power to legitimize its status through non-coercive means.”

Well said. The better and more efficient way to obtain, sustain, and legitimize hegemonic power in South America: “non-coercive means.” Now we need only ask which nation is doing a better job of this: the USA or China?

The companion Data Dashboard for this post breaks down the Chinese Investment per Year, per Sector, per Nation, and more. Please pay it a visit to understand better why the era of the Monroe Doctrine is over” and why the era of the “Xi Jinping Doctrine” seems well underway.

Our Work Here is Done — For Now

This is not a hate China, how evil is China rant. Not our cuppa. China pursues an overall global strategy that is unapologetically nationalistic. Why should we expect China to do otherwise? If you wish to get your China animosity on, you will find both content and community at The Epoch Times or at Fox News. (American Exile does value both sources). Likewise, American Exile makes it a point to read both AND Magazine and Michael Yon: neither of whom have much good to say about China. Sam Faddis of AND Magazine did offer an excellent brief on China’s stockpiling of strategic resources. On the same general concern, American Exile will have a forthcoming post in which we break down China’s global efforts at mining green metals and rare earth elements. But not here, not today.

This post and companion Data Dashboard (with more graphs and charts, including breakdowns per nation) provide an update on China’s extensive investment in and resource extraction from South America. Much can be said — and needs to be said —on these concerns. To both further inform and inspire those conversations, we at American Exile are making the available data more accessible and understandable by visualizing and summarizing key trends and developments.

The primary data source used here: China Global Investment Tracker, maintained by Derek Scissors at the American Enterprise Institute.

All graphs and data charts produced by Data Humanist for American Exile are released as CC0 1.0 (Universal Public Domain). Otherwise, all other sources indicated by link in text. As standard for American Exile when working with publicly available data sets, this post has both a companion Data Dashboard and a Github Repo (containing the code, data, etc.). Data and method transparency, always: Open Source, Open Science.

Fine Print on the Metals Sector

We discussed briefly earlier China’s lithium mining operations in Argentina and Chile. For the Metals sector, the otherwise excellent data set China Global Investment Tracker does not breakdown the investments into categories which include Lithium: the categories are Aluminum, Copper, Steel, or Unspecified. So for the graph below, which breaks down the Metals sector by subsectors, please assume that a good portion of the Unspecified is lithium and/or other green metals or rare earth elements.

Likewise, a deposit rich in one metal ore often also contains other elements of value. To return to example we started with, the copper mountain — Mount Toromocho in Peru — also contains proven reserves of molybdenum (essential to many steel alloys) and silver (a multipurpose precious metal and green metal).

Finally, please know that all data representations — both visualizations and summary statistics — are necessarily simplifications of complex realities. For this post and the companion Data Dashboard (with GitHub Repo), we are working with the best Open-source intelligence and data currently available. Thank you for your understanding.

Standard disclaimer: Our link to or citation of any source or person does NOT imply that source or person in anyway endorses American Exile. Our preferred pronouns remain: “small fringe minority” & “unacceptable views.”