Russia, a convenient enemy; China, not yet.

Notes on the USA balance of trade with China and with Russia, and on the dollar hegemony we can likely no longer sustain as it depends on our current rivals and probable future enemies.

The great John J. Mearsheimer explains why China, the obvious rival to USA global hegemony, has been theorized away to frenemy by many in our power elite:

China’s economy is tied to the economies of its rivals, and this linkage means not only that China and its trading partners depend on each other to keep prospering, but also that prosperity depends on their peaceful relations. A war involving China would be tantamount to mutual assured destruction at the economic level. Hence, economic interdependence will keep the peace in Asia as China rises. (The Great Delusion, 2018: p. 192).

This is NOT Mearsheimer’s view of China, but his summary of what he takes as neo-liberal wishful thinking about China’s emergence as an Asian (and soon enough, global) hegemonic power.

Accurate or not, and at American Exile we highly recommend The Great Delusion (2018), Mearsheimer’s summary does capture an essential truth about the USA-China relationship.

It also suggests indirectly why the USA was so ready to impose economic sanctions on Russia, but why the same tactics would not work when dealing with China.

The graphs below, all of which are available CC0 (Public Domain), provide a simple overview of the differing economic relationships the USA has with China, and with Russia. The data source: our government, of course, at Foreign Trade.

USA Trade Relationships: China and Russia

We will begin with China, for which we have data for the years 1985 to 2021. Exports are in black; imports are in red.

From 2014 — the year of Ukrainian coup or revolution — to 2021, we have a total trade volume (exports + imports) in millions of USD ($) as follows:

The economic relationship with Russia differs vastly. For example, to take the recent but non-Covid year of 2018, the USA had a total trade (imports + exports) of $658,795 million with China; but as we will see shortly below, a total trade of $27,503 million with Russia. So for 2018, the USA total trade with China was roughly 24 times greater than that with Russia.

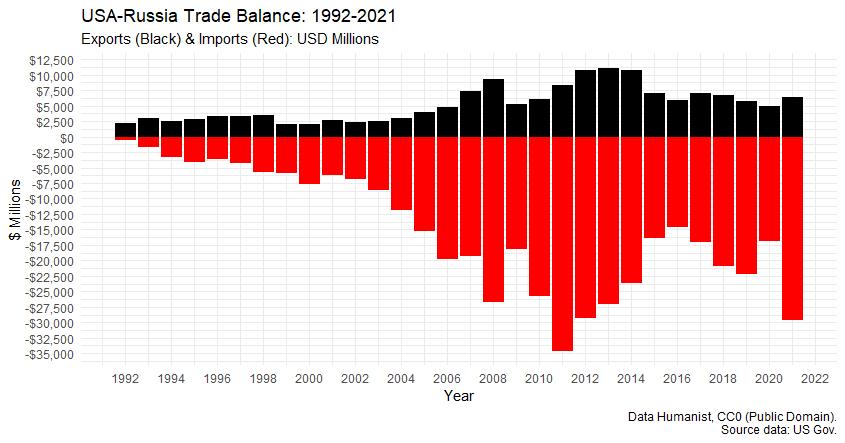

Now, for Russia

For Russia, we have the years 1992 (after the fall of the Soviet Union in 1991) to 2021. During that time period, the total trade (exports + imports) went from an estimated $2,594 million to $36,083 million. Roughly, 14 times greater — but still both in scale and total size lagging that of China.

In 1992, total USA trade with China was $33,146 million; in 2021, $657,432 million. So roughly 20 times greater. Likewise, to take the recent year for which we have complete data, for 2021, the USA total trade with China was roughly 18 times greater than the total trade with Russia: 657,432 / 36,083.

To match the comparison made previously, from 2014 — the year of Ukrainian coup or revolution — to 2021, we have a total trade volume (exports + imports) in millions of USD ($) with Russia as follows:

In other words, the total trade with Russia for any given year from 2014 to 2021 is LESS than (within) one standard deviation from the mean of the total trade with China over the same period. Not a rounding error, but nor a remarkable fluctuation.

For the years 2014-2021, total trade (exports + imports), with all figures in USD millions: the Chinese mean, $604,632; the Chinese SD, $41,160; the Russian max, $36,083; the Russian mean, $26,968; and the Russian SD, $5,745.

So as some of our power elite might believe, is it “the economic interdependence of Asia” that currently “keeps the peace” — as Mearsheimer puts it? It seems rather the USA’s dependence on Chinese goods and trade is what keeps our peace for now.

In regard to Russia, we have no such trade dependence and hence no related quality-of-life dependence. But the nations which do depend on Russia for fuel and fertilizer, for energy and for the ability to feed themselves — these nations must sacrifice.

Trade Imbalances Compared

We will begin with again China, for which we have data for the years 1985 to 2021. Over this period of time, the USA trade imbalance (deficit) with China has increased substantially. In 2021, the trade deficit totaled $355,302 million. In the same year, the USA had a total population of roughly 333 million.

A Per Capita ratio of the trade deficit is a provocative but not always meaningful indicator. Some ardent globalists will proclaim such a metric sheer nonsense. But to simplify the math, let’s divide each side by one million. That leaves us with 355302 / 333; or, roughly $1067 per USA population member.

In 1990, the USA had a population of roughly 249 million people; and a trade deficit with China of roughly $10,431 million. To simplify the math, let’s divide each side by one million. This leaves 10431 / 249; or, roughly $42 per USA population member.

So from 1990 to 2021, the Per Capita Trade Deficit expanded roughly $42 to $1067 — the hypothetical deficit load per person. Let’s adjust for inflation:

Core inflation averaged 2.31% per year between 1990 and 2021 (vs all-CPI inflation of 2.41%), for an inflation total of 102.91%. When using the core inflation measurement, $1 in 1990 is equivalent in buying power to $2.03 in 2021, a difference of $1.03.

So our $42 Per Capita Trade Deficit in 1990, accounting for core inflation, would equal roughly $85 in 2021. But even after this adjustment, we still have a $982 difference between the 1990 and the 2021 estimates for Per Capita Trade Deficit. That increase from our adjusted 1990 base of $85 to the 2021 estimate of $1067 marks a power-shift.

From what stocks the Amazon warehouses to what stocks the shelves in our vanishing retail stores, we find goods from China. The American way of life, such as it, depends on our deficit trade with China. Expect that deficit to keep increasing — and our perhaps soon one-sided dependency relationship, to likewise deepen.

Now, for Russia

In contrast, although the USA runs a trade deficit with Russia (a deficit which started in 1994), it is considerably lesser than that with China. For Russia, we have the years 1992 (after the fall of the Soviet Union in 1991) to 2021.

For our example year of 2018, just prior to the Covid-19 impact on world trade, the USA trade deficit with China was an estimated $418,233 million; with Russia, $14,187 million. In other words, the USA trade imbalance with China was roughly 29 times greater than that with Russia. (Data source, once more: USA Gov. @ Foreign Trade).

So again, our government has no fears cutting economic ties with Russia. In the words of Elton John, horribly misused for this occasion: “it’s no sacrifice / No sacrifice / It’s no sacrifice, at all.”

Economic Sanctions are Easy, Wars Profitable

Yes, economic sanctions are easy — when USA is sanctioning a nation which matters neither to our economic stability nor to our quality of life. Likewise, wars are good for some sectors of our economy — when other people fight them in other places, but use weapon systems developed in the USA.

Remember, no matter what the eventual outcome of a conflict or war is — whether from Iraq, to Libya, to Afghanistan, to Ukraine, to insert here — one thing is certain: our military-industrial complex gets paid. With USA taxpayer dollars, if need be.

Below, a truth-bomb montage by the indispensable Matt Orfalea — for Matt Taibbi’s post on our MSM news coverage of the Russia-Ukraine war as a series of commercials for weapons dealers, “The Gentlemen’s Agreement” (26 April 2022).

On the same general concerns, Useful Idiots, with Katie Halper and Aaron Mate holding down the fort, offer an instructive interview with the economist Michael Hudson as to how all this might well collapse back on the USA: “Sociopath Neocons Sacrifice Ukrainians and Global Poor” (29 April 2022). Polemic, but truly insightful.

Please consider also Brian McGlinchey’s outstanding assessment, “Weaponized Dollar May Explode in America's Face” (10 April 2022), at Stark Realities, one of our top-tier sources for thoughtful, evidence-based, nuanced but hard-nosed analysis and opinion.

China Has Other Plans, Do We?

Not everyone is happy with global food shortages. Not everyone is happy with further attempts at USA dollar ($) hegemony and Bretton Woods dominance. For now, China needs American consumers. For now, China needs the USA currency ($) to have some value. But the Belt and Road Initiative proceeds slowly, slow but steady.

Map below courtesy of the Belt Road Research Platform, a joint collaboration between the Leiden Asia Centre, the Clingendael Institute, and the Leiden University Institute for Area Studies.

As China economically integrates across Eurasia and Africa, China has less need for the USA, a nation of now roughly 333 million people — many of whom are already in debt, living on credit, and dependent on social subsidies, various welfare programs.

According to Victor Davis Hanson, whose The Dying Citizen (2021) is essential reading:

A fifth of America receives direct government public assistance. Well over half the country depends on some sort of state subsidy or government transfer money, explaining why about 60 percent of Americans collect more payments from the government than they pay out in various federal income taxes, in various health care entitlements, tax credits and exemptions, federally backed student and commercial loans, housing supplementals, food subsidies, disability and unemployment assistance, and legal help.

These programs in turn depend on the USA dollar ($) remaining the world’s reserve currency. We can afford our social spending because other nations buy our debt. We can have 1/5 of our nation seemingly permanently on the dole — with a considerably larger population consisting of working poor and alleged middle class households. Even with our existing safety nets, our current welfare spending, many of these people are just a few missed paychecks or one major medical emergency away from homelessness and/or crippling personal debt. Should China care? Should the EU?

Moreover, do the nations which buy our Treasury Bills and hence shares of our national debt, the nations which collude with us in keeping the dollar afloat, do these nations desire also to keep financing our wars? Knowing well that they might be next?

Ask China. Ask Saudi Arabia. Ask about the petrodollar’s future. Ask even the EU.

Our dependency on China might not be enough to ensure China’s dependency on us.

Thank you sincerely for considering American Exile as an alternative source of analysis and commentary.

Free Graphs: The four graphs created by Data Humanist for this post are licensed CC0 (Public Domain), and are free to use however you see fit.

Standard disclaimer: Our link to or citation of any source or person does NOT imply that source or person in anyway endorses American Exile. Our preferred pronouns remain: “small fringe minority” & “unacceptable views.”

GEEEZUZ, these ppl are horrible. And it's just death, death, death -- of OTHER PEOPLE, so why should they care, when they get MONEY MONEY MONEY. It's time to shut this war machine DOWN, I say.