Chinese International Investment: Energy and Metal Sectors

Why does this matter? Clean Energy Technology depends on green metals and rare earth elements. Even upgrading a conventional power grid requires the same. For now, China controls the future.

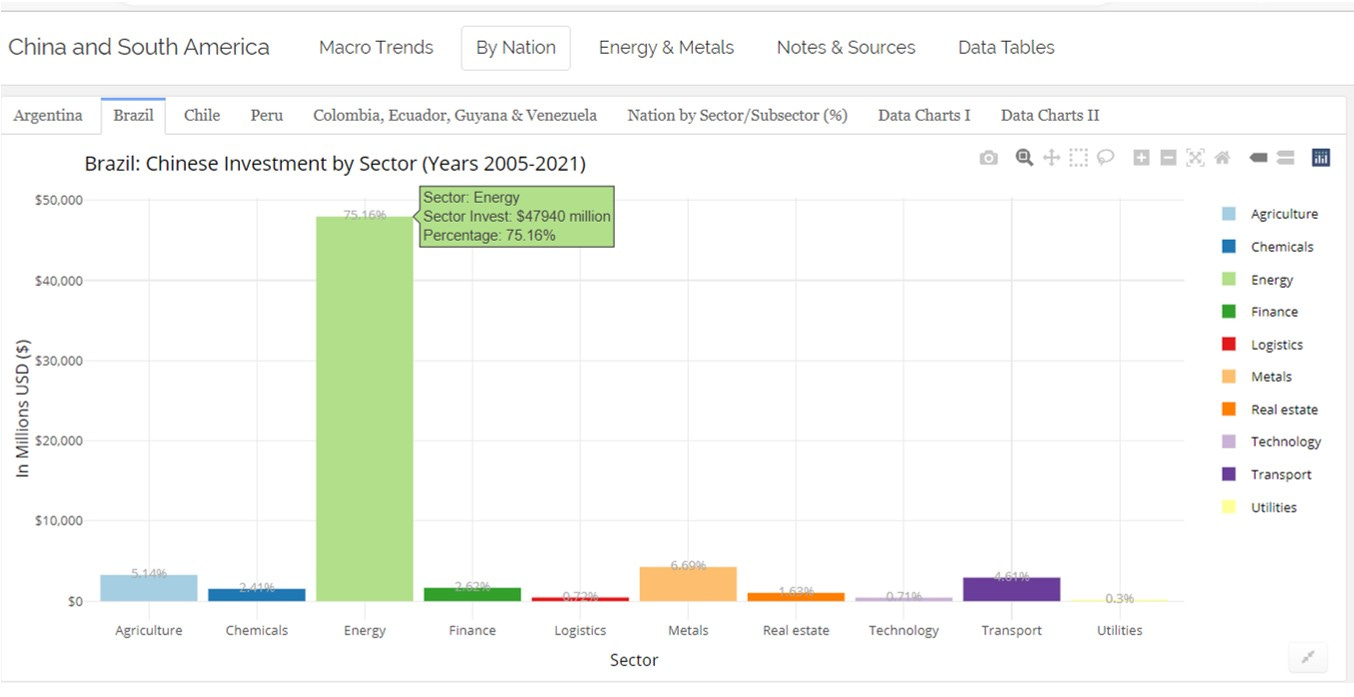

American Exile covered previously China’s massive investment in South America: “Buying the Copper Mountain was only the Beginning” (16 June 2022). Although we focused on the data, we did outline the energy, economic, and security implications of China’s new dominance in South America. Below, Brazil from our Data Dashboard.

About two weeks later, completely unrelated to our efforts but demonstrating cogent awareness of the general situation, Tucker Carlson went to Brazil to do an upcoming Fox Nation special on China and Brazil: “Allowing Brazil to become a colony of China would be a significant blow to us” (Fox News, 30 June 2022).

The designation “colony” — as we will explain in an upcoming post on China and Africa —distorts more than it reveals. But we thank Tucker Carlson for his efforts.

Green Metals and Rare Earth Elements

China’s investment in South America is part of a larger global strategy. To be sure and always, China is concerned with securing resources, gaining markets, and building political alliances. But even while it continues to import and burn fossil fuels, including coal from Russia at bargain rates (CNBC, 29 June 2022), China has an energy strategy centered on stockpiling green metals and rare earth elements to become a global leader of clean energy technology (“Copper Mountain,” 16 June 2022).

A quick refresher on the terms green metals and rare earths:

Green metals, to cite NASDAQ (31 May 2022) , “include familiar fare such as copper, lithium, tin, and zinc, among others, are integral in the production of clean energy concepts including batteries, solar panels, and more. In other words, green metals have long-term tailwinds.”

Rare earths are 17 elements with conductive and magnetic properties essential to much of modern technology (FPRI, 2 March 2022). They are used for manufacturing fuel cells, optics, lasers, ceramic capacitors, hard disk drives, et cetera; used as catalysts for petroleum refining, for enriching fertilizer, for medical tracers, et cetera; and the list goes on and on (Wikipedia, 22 June 2022).

China’s Strategic Rare Earths Dominance

China’s strategic dominance of rare earth elements has been well-documented. The Investment Monitor (26 April 2022) claims that “China’s stranglehold of the rare earths supply chain will last another decade” and “China is set to continue enjoying an 80% share of the global refining of the vital metals.” The Investment Monitor (26 April 2022) also reports:

“The annual demand for REEs doubled to 125,000 metric tonnes (t) in the 15 years to 2021 and is projected to reach 315,000t in 2030. . . . Rare earth oxides are essential to many industries worth trillions of dollars.”

Bloomberg News conceded dominance to China awhile back, explaining “How China Overpowered the U.S. to Win the Battle for Rare Earths” (11 June 2019). But China has not stood still, and so Bloomberg News further updated its claim when China merged six key producers to create a “behemoth that will strengthen its control over the global [rare earth] industry it has dominated for decades” (23 December 2021), even while demand surges and the USA and other nations play catch-up:

“Rare earth prices have surged this year as demand outpaced supply, while a power shortage exacerbated disruptions and a broad rally in commodity prices increased production costs. Neodymium and praseodymium — two elements used in permanent magnets — have jumped to the highest in a decade.”

The Wall Street Journal (3 December 2021) likewise reported “China Set to Create New State-Owned Rare-Earths Giant” which would “strengthen China’s dominance of the global supply chain around the strategic metals.”

The USA on Defense

So good for China, which has threatened to restrict rare earth exports. Because as Steve H. Hanke of the Cato Institute points out (25 February 2021):

“an [American] F-35 [combat aircraft] contains 417 kilograms of valuable rare earths — minerals over which China has a virtual choke hold. . . . But rare earths are not just vital for many weapons systems. Far from it. They are also used in a wide range of consumer products from iPhones to DVD players to rechargeable batteries.”

China is willing to manufacture iPhones for the USA market, but would rather not supply the USA with key resources needed to produce predator drones or combat aircraft. Or even solar panels. Our think-tank elite consider this unfair. Unsporting. A proper capitalist will sell you the rope you need for hanging him. Or yourself. Free markets and Fentanyl, for example. Just expect China to act in China’s best interest.

His biases aside, Hanke (25 February 2021) does excellent work in breaking down China’s commitment to developing top-level university programs in Mining and Mineral Engineering, Metallurgical Engineering, and Materials Science and Engineering. In terms of the top Global 20 per specialization listed above, China’s numbers are 45% MME; 45% ME; and 25% MSE. Bottom-line: China is all-in on rare earth elements.

Threats and Pushback

Given these developments, the “China Power Project” at the Center for International Studies (2022) wonders: “Does China Pose a Threat to Global Rare Earth Supply Chains?” Downplaying the threat, CIS believes that increased global production might offset China’s advantage, as represented in their graph shortly below. But CIS in our opinion does not well account for the increased global demand. Over the next two decades, as East Asia Forum reports, the “demand for rare earths is forecasted to increase by two to eight times over current supply” (30 March 2022).

At the same time, the world is undeniably waking up. Even the USA, as Bryant Harris of Defense News (23 May 2022) has reported: “Congress and Pentagon seek to shore up strategic mineral stockpile dominated by China.” The USA does import roughly 80% of its rare earth elements used in manufacturing from China (CIS, “Reliance” 2022).

But China Marchs On

At the Foreign Policy Research Institute, Felix K. Chang (2 March 2022) astutely catalogues and analyses both China’s successes and failures in maintaining “their global dominance over rare earths production.” In particular, Chang (2 March 2022) cogently observes that Chinese companies

“will have to more aggressively expand overseas. It turns out rare earth metals are not so rare; they are found all over the world. And as the world has grown more aware of the value of rare earth metals, the ability of Chinese companies to easily strike favorable deals may wane.”

Yet Chinese companies are aggressively expanding overseas. So time now for American Exile to make a minor contribution to the conversation.

Visualizing China’s Global Investment

Based on the China Global Investment Tracker, maintained by Derek Scissors at the American Enterprise Institute, we will visualize and examine China’s Direct Foreign Investment in the Energy and Metals sectors. We are tracking data from years 2005 to 2021, for every verifiably known international (not domestic) investment by China.

As we noted elsewhere (16 June 2022), the Energy sector is not simply fossil fuels — not simply extracting oil for export to China, although that certainly has a major role. China has also built hydroelectric dams, has been in discussion about building nuclear power plants, and has built the largest Solar Park in Latin America.

Likewise, the Chinese Metal sector investments also concern lithium, other green metals, and the rare earth elements. These bridge the Metals sector (as raw resources) and the Energy sector (as part of a finished technology offering). From the same nation, China will extract the raw resource, and then sell it back as a value-added product as part of an infrastructure development project connected to the Belt and Road Initiative. In contrast, the USA will offer a moral lecture on climate change.

Energy Sector

Let’s start with the global overview — the totals by nation for years 2005 to 2021. The top five are Brazil, $47,940 million; Canada, $41,720 million; Australia, $36,730 million; Russia, $21,380 million; and Kazakhstan, $18,360 million.

Now for the yearly totals. The top five years: 2010, $41,500 million; 2021, $40,270 million; 2019, $37,720 million; 2011, $36,950 million; and 2013, $35,550 million.

The totals by sector: Unspecified, $142,690; Oil, $124,380 million; Gas, $54,860 million; Coal, $40,000 million; Alternative, 33,220 million; and Hydroelectric, $31,040 million.

We can breakdown the subsector investments per year (for all nations). Please notice that even as China starting in 2011 has consistently invested in Alternative (Green Energy), China has still invested a greater amount in Coal over the same period.

A Global Cleavage?

Sundance (2 July 2022) at The Last Refuge (hat tip to Zero Hedge) offers an outstanding analysis of BRICS reaching out to Saudi Arabia, claiming that if Saudi Arabia does join the potential outcome would be

“a global cleaving around the energy sector taking place. Essentially, western governments’ following the ‘Build Back Better’ climate change agenda which stops using coal, oil and gas to power their economic engine, while the rest of the growing economic world continues using the more efficient and traditional forms of energy to power their economies.”

China, despite its long-term commitment to Clean Energy technology (“Copper Mountain,” 16 June 2022), has already cleaved off from the WEF timeline if not greater agenda. China will burn fossil fuels until it is ready, all the while stockpiling the essential resources for Clean Energy technology and developing “Green New Deal” infrastructure and products for those willing and able to pay.

If Saudi Arabia signs on to BRICS along with Argentina and Iran, Sundance (2 July 2022) argues that such would

“essentially be the end of the petrodollar, and — in even more consequential terms — the end of the United States ability to use the weight of the international trade currency to manipulate foreign government. The global economic system would have an alternative. The fracturing of the world, created as an outcome of energy development, would be guaranteed.”

We cannot speak for what Saudi Arabia will or will not do. But China’s global energy investments and domestic practices are entirely consistent with and well-explained by the analysis which Sundance has offered.

Metals Sector

According to Alec Dubro (14 June 2022) at Foreign Policy in Focus, the “United States has a problem with rare earths, and it’s largely a problem of its own making”:

“Ninety percent of these essential — but by no means rare — minerals are now under the control of China, a country that either is or isn’t our enemy. And the United States is largely responsible for this situation. Not so long ago, the United States was the world’s largest producer of rare earths until the private sector, with government acquiescence, decided to offshore the production.”

The USA decided to offshore, and China decided to conquer overseas by investment and mining. Below, the global overview — the totals by nation for years 2005 to 2021.

The heavy Chinese investment in Australia, $34,180 million, is also investment in Australia mining companies which have sites elsewhere. (The same holds for Canada). So this extends China’s global reach beyond Australia. To better understand China’s global commitment, let’s take the next top 10 nations (with region indicated):

Peru, South America, $15,790 million; Indonesia, East Asia, $12,920 million; Congo-Kinshasa, Sub-Saharan Africa, $12,640 million; Canada, North America, $9,010 million; Chile, South America, $6,190 million; Brazil, South America, $4,270 million; Sierra Leone, Sub-Saharan Africa, $4,220 million; South Africa, Sub-Saharan Africa, $3,850 million; Guinea, Sub-Saharan Africa, $3,730 million; and Ecuador, South America, $3,610 million.

The investments show clearly China’s dominance in the Global South, particularly South America and Sub-Saharan Africa. Now, let’s have a look at yearly totals.

One qualification, please. For the Metals sector, the otherwise excellent data set China Global Investment Tracker does not breakdown the investments into categories which include Lithium or the rare earth elements: the categories are Aluminum, Copper, Steel, or Unspecified. So for the graphs above and below, which breaks down the Metals sector by subsectors, please assume that a good portion of the Unspecified is lithium and/or other green metals or rare earth elements.

We know for certain that China has been mining lithium in the South American nations of Argentina (Nikkei Asia, 13 October 2021), Chile (Asia Financial, 13 January 2022), Peru (Asia Financial, 27 April 2022), and likely Bolivia next (Stockhead, 25 May 2022). In Sub-Saharan Africa, China has been mining lithium in Zimbabwe (VOA, 4 June 2022), and controls the majority of the mining sector in Congo-Kinsasha (DRC), including the cobalt mines (ASPI, 6 December 2021; SCMP, 3 April 2022). Yet another essential green metal, cobalt is used for fuel cells (including lithium batteries), high-tech steel alloys, and much more. So, again, the Unspecified subsector certainly includes strategic green metals and/or rare earth elements.

Moreover, a deposit rich in one metal ore often also contains other elements of value (“Copper Mountain,” 16 June 2022). The copper mountain — Mount Toromocho in Peru — also contains proven reserves of molybdenum (essential to many steel alloys) and silver (a multipurpose precious metal and green metal).

We can breakdown the Chinese subsector investments by year.

The gross total for each subsector (all years): Steel, $53,360 million; Unspecified, $42,090 million; Copper, $41,500 million; and Aluminum, $23,970 million.

But Mining and Development are Ecocide!

In response to all this Chinese investment and activity, the American Center for Strategic & International Studies (CSIS) has produced a delusional policy recommendation sheet for the Biden-Harris administration. One which centers on John Kerry, Special Presidential Envoy for Climate, lecturing South America into submission about ecocide and the superior Direct Lithium Extraction (DLE) technologies which the USA does not have yet but is developing (17 August 2021).

If such is the best the USA can do, game over: China deservedly has hegemonic control over the future of energy, and we all — from Afghanistan to Liechtenstein to Zimbabwe, from Tuvalu to Mexico to Belgium — live with the consequences.

Use Freely: All graphs and data charts produced by Data Humanist for American Exile are released as CC0 1.0 (Universal Public Domain) with a Github Repo (containing the code, data, et cetera). Otherwise, all other sources credited by link in text.

Disclosure / Conflict of Interest Statement: Your author Data Humanist once lived and worked in mainland China for over 5 years, and still (as of July 2022, perhaps ending soon) holds an appointment at the rank of Professor in the College of Liberal Arts at a university in Guangdong Province. As your author has recently taught online courses (remotely) for the same university, you may consider my scant compensation as a possible financial conflict of interest if you so please.

Standard disclaimer: Our link to or citation of any source or person does NOT imply that source or person in anyway endorses American Exile. Our preferred pronouns remain: “small fringe minority” & “unacceptable views.”

The quality of this analysis is insane, thank you!

Okay, so check this guy out!! Wowza!

https://duckduckgo.com/?q=Daniel+Nocera&hps=1&atb=v314-1&iax=videos&ia=videos&iai=https%3A%2F%2Fwww.youtube.com%2Fwatch%3Fv%3DDhg6VRex7uQ